As a guy with two degrees in finance who’s achieved early retirement, I wish I could shove all those years of study and research into my friends’ heads to help them have a happy, secure retirement or even early retirement. Of course, that’s impossible. But I can boil down it down to its essence to help you on your way to a better, early retirement.

Beware: Greed and Fear Drive the Finance Industry

Yup, I said it. And I’ll repeat it. Greed and fear drive the finance industry, and you can take that to the bank. Notice that doesn’t include anything about truthfulness. Most financial transactions involve someone trying to make money off of you so they can get paid. Don’t buy any financial products without educating yourself first.

I’ll never forget my first finance class. As a bright-eyed and bushy-tailed twenty-year-old, I’d finally gotten through all the English and History classes required for my degree. I looked forward to finally getting to learn what I’d paid all that money and waited so long for. So, I got to class early and sat in the second row because I hadn’t yet embraced my inner nerd enough to sit in the front.

Soon, a frazzled-gray-haired professor rushed in, holding a battered leather briefcase in one hand, clutching a big stack of disheveled papers in the other. He threw both onto the desk in the front of the room and squared his shoulders to face the class.

“Welcome to Introductory Finance. I want to warn you that if you can’t boil it down to dollars and cents, it doesn’t belong in this class. Finance is concerned about money and how to make more of it. No one cares about your feelings. If you can’t accept that, then there’s the door,” he proclaimed.

I scratched my head and wondered about the veracity of my vocation’s creed as the professor began to scribble equations on the board. Little did I know he was taking it easy on us newbies. The Greed and Fear axiom came in later classes. I later learned some economists make a case for the righteousness of this argument … more here.

The Early Retirement Answer Is: It Depends

The Real Estate Crisis of 2007 is a great example. People bid up the price of homes to a point higher than what they were worth. I don’t want to get into the weeds, but you need to understand that financial bubbles are a game of musical chairs. Say Joe bought a house that was worth $80,000 for $100,000. Now, Joe got a bad deal because he paid more than it was worth. But, luck was on his side because Susan got bitten even harder by the greed bug, and Joe got scared after seeing all problems and sold that house to her for $120,000. Then Susan got scared and sold it to Bob for $130,000. Everything’s golden while the music’s playing and everyone’s buying. But, you lose when you’re the last one standing, holding the bum investment, with no place to sit, as the bubble comes crashing down.

Avoid Getting Stuck with Bad Investments

Poor Bob got shafted because he bought later in the cycle even though Susan and Joe also paid more than the house was worth. He had terrible luck because the bubble happened to burst and he couldn’t find someone to buy it for more than he paid. Even the best financial minds agree that you can’t predict bubbles, and most aren’t 100% sure they’re real before they implode. Anyone who tells you otherwise is trying to sell you something. Do everyone a favor and buy a lottery ticket if you want to get your rocks off playing good luck / bad luck. If you don’t understand it, it’s a gamble, not an investment.

So how can you win this game with enough money and security for you to lead a happy, worry-free life? One way is to spend a lot of time and intellect reading lots of books and doing a lot of research before investing. If you don’t out-think and out-research everyone else, you’re going to be the one holding the lousy investment when the music stops. One of the best ways to win is never to play musical chairs.

Ben Graham, a world-class investor Warren Buffet’s mentor, wrote an excellent book for the layperson to get up to speed on finance and business basics, The Intelligent Investor. I’d recommend everyone read it … more here. In the spirit of full disclosure, I’ll get a small commission if you buy that book using this link. But, I’ll summarize one of the best strategies outlined there in this article. I’ve successfully used this strategy for years.

For the everyday Joe’s and Jane’s, you need some tried and true, easy rules of thumb.

Start Early, Work Hard, Save Your Money, and Invest Wisely, Retire Early

I know that’s a cliche, but IT WORKS ALL THE TIME. It’s easier than you think. The passing of time is inevitable and is actually one of the most important concepts in finance. Once you understand the Inevitability of Time, you need to tweak a few things to retire securely. For example, a small decision like a college student who decides to make his own coffee and save $4 a day instead of buying a Starbucks would result in over a quarter of a million dollars ready for early retirement. If he goes crazy and packs his lunch too, saving another $12/day, he’d be a multi-millionaire when he retires.

The Inevitability of Time

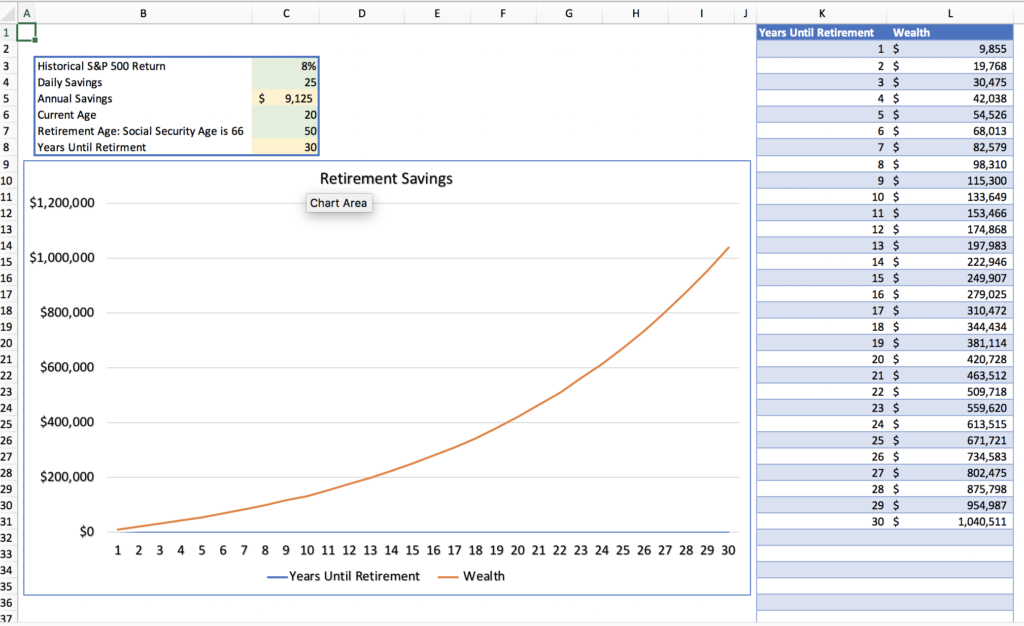

The miracle of compounding (… more here) transforms small amounts into millions over time, as shown below. After many years, our prudent college student’s early retirement strategy will result in a $2,879,767 nest egg. And he doesn’t have to worry about the ups and downs of the market because it will all average out in the long run. His $16 will buy fewer shares when the markets are up, and the same $16 will buy more when it’s cheap. Early retirement takes a little more work. A twenty-year-old would need to save $25 a day, which is totally doable but would require more discipline.

The key to all of this is merely the Inevitability of Time. That means starting to save early is HUGE! In fact, a fifty-year-old would have to save $258 a day to get to the same place. How could she do that? Live in a tent and eat grass?

That’s not to say all hope is lost for our dear fifty-year-old. After all, she probably doesn’t need the three million dollars our college student would have. And she could always work longer. But, waiting longer to save makes it harder than setting up a Mr. Coffee timer.

Check out my free Inevitability of Time Early Retirement Planning spreadsheet that details all these calculations. You can change things around to fit your circumstances and use it for your own financial planning … more here.

Inevitability of Time Early Retirement Planning Spreadsheet

On Investing

Investing is the tricky part. If you’ve downloaded my free Inevitability of Time Retirement Plan spreadsheet, you’ll notice that getting a really high return can also make a big difference in a happy retirement or even early retirement. But, outsmarting everyone else and getting a super high return on your investments is really hard. Saving consistently, following a Dollar Cost Averaging investment strategy, and investing in a well-diversified, low-cost index fund has given prudent investors a reliable 8% return ever since Ben Graham wrote The Intelligent Investor in the forties. Dollar-Cost Averaging over the long term with a diversified portfolio has been one of the best and easiest financial strategies ever.

People who want to sell you expensive financial products will usually say something like, “if you pick the right investment, it could go up a lot more than the overall average of 8% that you’ll get with Dollar Cost Averaging.” Or they might show you an example of where it goes wrong if you only invest over a short period of time right before a recession.

The Inevitability of Time Still Pays Off Big

All true as far as it goes. You might happen to pick a great stock that goes through the roof. You might win the lottery too. But the odds are very much against both. You could make a lot more money by choosing superior investments. I know because I’ve done it. But, being a serious investor rather than a gambler is at least a part-time job. I spend around ten to twenty hours a week working on my investments, and I make a good return. But, if you’re going to stake your early retirement on your investment business, then you better start with taking your financial education very seriously, and you better be really good with numbers. I’ve recommended The Intelligent Investor, but that’s just the beginning for the enterprising investor. You’ll need to spend hundreds of hours doing very in depth research.

The other main criticism: you might lose money if you start Dollar Cost Averaging right before the market tanks. Also true, but the ups and downs of the market will average out over time to around 8% if you stick with it. I park my money for Dollar Cost Averaging in low-cost S&P 500 Index Funds at Vanguard and Schwab, which has worked out really well for me over many years. But any low-cost, well-diversified index fund or ETF will do something similar.

I’ll link some more articles for you below if you’d like more information. But, make sure you ask for funds with low expense ratios. You can put your Dollar Cost Averaging plan on autopilot by setting up your account, so it automatically invests your savings in the fund of your choice. Do it and forget about it. Don’t touch the money, and watch the Miracle of Compounding work for you.

4 steps to a Peaceful and Prosperous, or Early Retirement

4. Get on with your life and let your savings grow. You’ll be tempted to monkey around with it or to sell when the market tanks, which it will at some point. But don’t. Leave the plan in place and keep investing so you’ll be set when the market goes back up.

More Research, Links to Key Concepts:

- Dollar-Cost Averaging

- Expense Ratio Explained

- Index Funds Explained

- Importance of Diversification

- Historical Returns of S&P 500 Index

- The Intelligent Investor

- Free Inevitability of Time Financial Planner

What do you think?

Thanks for reading to the end! This blog is my project in the pursuit of truth. I spend dozens of hours researching each blog post, so I hope you found something useful.

Our click-bait culture needs good ideas in an increasingly complex world. That depends on good men and women engaging in intellectually honest discussions, sharing ideas, and challenging each other’s thinking. Writing out my thoughts in detail, along with lots of research, helps me arrive at a more accurate view of truth based on well-documented facts.

I try my best, but I’m not always right. So, leave a comment or send me an email if you have something to add. I’d love to hear from you and learn something new.

Also, if you like my blog, please help me recruit others to join my search for truth by sharing this on social media and signing up for my newsletter.

Leave a Reply

Your email is safe with us.