Many critics of Trump’s Tariffs question how they benefit the US economy. Despite ample criticism, two years into the Trump presidency the economy’s booming. The unemployment rate is the lowest since the 1960’s. According to uber leftist NPR, Black and Hispanic unemployment are the lowest in recorded history. GDP growth is over 4%, and consumer confidence is nearly the highest so far this millennium.

Of course, the economy also grew during Obama’s time in office. But, the economy is growing at a statistically significantly higher growth rate under Trump than under Obama.

Since the US economy is influenced by many factors, one can’t prove Trump alone caused this growth. But, Trump has taken bold actions to spur economic growth. We hear so much misinformation and outright falsehoods, I think an objective look at the facts worthwhile.

Paul Krugman, the New York Times columnist, wrote just after the 2016 election that the economic sky would fall and Trump would destroy all that’s good in the world. The Democratic House Leader Nancy Pelosi said that Republican’s Economic Reforms were the “end of the world … this is Armageddon.” She went on to emphasize that thousand dollar bonuses given to working-class people as the result of the reforms were mere “crumbs.” Watch this clip of her comments.

These types of bias and hyperbole distort people’s ability to make sense of the world. Sadly, we’ve come to expect this from politicians and the Mainstream Media. Recent polls show that more than 70% of Americans don’t trust traditional media. But even IDW intellects like Ben Shapiro and many academic economists question Trump’s Tariffs.

I’ll try my best to show that Trump’s tariffs make sense in the context of a broader economic policy which has been, and I believe, will continue to be, beneficial to the United States.

Trump’s Tariffs

Critics point out the negative aspects of tariffs but seem to ignore the big picture. They claim that charging tariffs on imports would hurt the economy by creating economic inefficiencies and result in higher prices. The argument is that many of the things Americans buy are imported. So, businesses will raise their prices to cover these tariffs. American consumers will be forced to cover the cost, resulting in an indirect tax. I agree that could happen if the tariffs impacted all or most imports.

Tariffs Only Cover a Small Portion of Imports

Trump imposed tariffs on $250 billion worth of Chinese imports. But, it’s only 1.3% of America’s 19 trillion dollar economy. So, a 25% tariff would be small 0.33% (or about $62 billion) of the economy. That’s a small impact, so no Mr. Krugman – the sky isn’t falling.

Americans Still Good at Making Things

The critic’s argument assumes that prices will rise because US manufacturers cannot produce the needed products at a similar or lower cost than the overseas competition. That’s probably true for imports from China. But not true of products made in other developed economies like Europe and Canada. So, consumers won’t suffer long-term prices increases on imports from other advanced economies because Americans can make the products for the same price or cheaper.

But, the critics’ argument ignores the fact that we can buy manufactured goods from other low-cost countries like Vietnam. So, it seems far from certain that prices will increase due solely to tariffs on Chinese goods.

Inflation’s Still In Line with Historic Trends

So far at 2.3% inflation’s in line with historical trends. Inflation is a good measure of cost changes. If these tariffs continue for a few years and if US manufacturers or other non-tariffed trade partners can’t find a way to produce specific products at a lower cost I think it reasonable that there would be a minor impact on inflation. But, even that would take time to be felt since businesses hold some pre-tariff inventory. Even if there is an impact, it will be small. One-third of one percent isn’t a big enough part of the economy to move the needle that much.

Tariffs a Temporary Carrot and Stick

Critics may argue that imposing modest tariffs could lead to a trade war which escalates out of control. I believe that’s unlikely. The US economy has a lower relative reliance on external markets and its larger economy makes it a more desirable trading partner than other countries. So far indicators suggest other countries will not escalate a trade war. Trump recently concluded successful negotiations with Mexico and Canada to replace NAFTA with USMCA. China’s imposed retaliatory tariffs on US goods, but only in direct proportion to US tariffs.

The President has repeatedly asserted that the tariffs are part of a negotiation game to correct bad trade deals. This article says it best:

“the best analytical approach for understanding the [tariffs] is game theory — in particular, by thinking of different strategies and outcomes in a world where a traditionally cooperative game is being played uncooperatively.

The U.S. was destined to win this new game because of its economic strength and diversity, entrepreneurial agility, and lower relative reliance on external markets. How long it would take for it to prevail depends on how quickly other players come to terms with a new reality (including the Trump administration’s willingness to risk economic damage and its embrace of a negotiating stance that shows less respect for established practice and cordial relations with allies). As such, acceding to U.S. demands would not be the best outcome for others but would still be much better alternatives to a full-blown trade war.

This helps explain why Mexico and the EU have softened their stance. It also is the reason why Canadian Foreign Minister Chrystia Freeland rushed to Washington this week to try to meet the Trump administration’s negotiation deadline. These developments also suggest that it’s only a matter of time before China softens its position, especially now that there are improved prospects for a joined North America-European position on Chinese practices on intellectual property rights, joint venture requirements and some non-tariff barriers.”

Trump’s Tariffs could have a minor adverse effect on the economy if they go on for years. But, they’re part of a broader Republican Economic Plan that should be considered in its totality. Republican’s Economic Reforms will drive long-term prosperity for the United States far into the future. Now, let’s discuss the other moving pieces.

Why We Need Trump’s Tariffs

It’s true that high tariffs imposed forever on all imports would cause prices to rise and hurt the economy. But, that’s not what’s happening. Trump’s using tariffs as a carrot and stick to renegotiate more favorable trade deals.

Academic economists assume “all else being equal,” but that’s not a valid assumption in the real world. Trump’s tariffs, when considered in isolation, are a minor negative. But, life doesn’t happen in isolation.

All Else is Not Equal

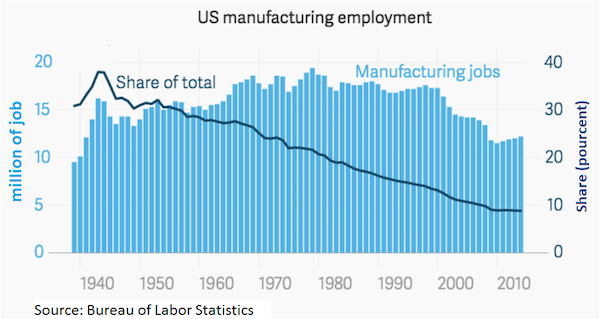

Even when folks like China negotiate a trade deal at our expense, they sometimes break the rules to further their interests. I don’t blame China. I, along with every reasonable person in the history of forever, try to make the most of my business deals too. The blame lies with American leaders of the Clinton-Bush-Obama era, clinging desperately to the outdated establishment notions of “free-trade” at any cost. Free trade at any cost hurts American workers. Starting in the mid-1990’s, with the passage of NAFTA, US manufacturing jobs went into steep decline, as shown below.

Strengthening Intellectual Property Protections Critical to a Knowledge Economy

But, manufacturing jobs aren’t the only area that’s suffered. China’s intellectual property theft costs the U.S. economy between $225 billion to $600 billion annually, according to the Commission on the Theft of American Intellectual Property. That’s about four to ten times more than the economic costs of the tariff on Chinese goods. So, if we keep the Chinese tariffs, which isn’t the intention, then Americans will still come out on top if we can prevent this one aspect of disadvantage. But, Chinese trade abuses aren’t limited to Intellectual Property, and the WTO is not equipped to resolve these issues.

Protection of Intellectual Property is an especially important area for the future of the US as our economy increasingly relies on information and knowledge rather than industry. Strengthening IP protections is a central focus of Trump’s negotiations as was recently accomplished in the USMCA.

Trade Abuses

Let me be clear. I, and I believe Trump, are not advocating for Protectionist Trade Policies. Competition is good for the economy. Finding new and more effective ways of doing things is good and should be rewarded, whether in the US or overseas. But, Free Trade shouldn’t require accepting trade abuses and unfair economic practices in violation of trade agreements or WTO rules.

I haven’t seen any evidence that Trump’s Trade Policy is Protectionist. He’s advocating fair and free trade as he explains in this clip. False claims to the contrary and overly simplistic hyperbolic clickbait headlines harm our economic interests by convincing voters to abandon fairness for our people. Here are examples of common trade abuses by US Trading Partners.

China routinely engages in intellectual property theft according to US Trade Representative Reports. Suppose a US software company works hard and spends 100 million dollars developing new PC software. They plan to recoup this investment by charging $50 per license for computers sold with their software. But, a Chinese computer manufacturer pirates this software, installs illegal copies on their laptops, and sells them for $50 less than American companies. They’ll sell more computers since their price is much lower. When the software company objects then the Chinese government fails to enforce WTO trade laws and punish theft. But, critics advocate acceptance of this in their advocacy for Free Trade at any cost. Here’s a more complex example of software theft. If that’s not enough for you, read about these Top Ten Cases of Chinese IP theft.

Canada imposes steep tariffs on American dairy and egg products. But, Trump’s “Free Trade” critics attacked him for objecting to this unfair treatment of US Farmers. I don’t understand how other countries charging high tariffs on American products is “free-trade,” but the President’s establishment critics think we should bend over and take it.

Long-Term Focus

Politicians too often focus on short-term expediencies instead of smart long-term strategies. That’s why I like Trump’s multi-faceted approach. But, its complexity makes it impossible to boil down into a tweet or a click-bait headline.

Trump’s using the tariffs as a negotiating tactic to get better long-term trade deals. But, tariffs could hurt the economy a little in the short run. So, why do we see such strong economic growth? What other features of Republican Economic Reforms are at play?

What is Wealth?

According to neo-classical economic theory, wealth is created in one of two ways. People can do more stuff in the same old ways, or people can use new technology to find a more efficient way to do things. Scott Hodges uses fancy words to say the same thing in his testimony:

… the main drivers of economic output are the willingness of people both to work and to deploy capital, such as machines, equipment, factories, etc.

Let’s break this super-important concept down in the form of a thought experiment.

Suppose you’re a cave-person and you’ve figured out you can grow food if you stick seeds in the ground. So, you shove the closest stick into the ground to make a hole then drop some seeds in after it. Now, there are two ways you can grow more food. You can recruit your cave-compadres to shove more sticks in the ground, or you can figure out how to build a plow.

By the way, if you want some tips you can use to increase your own wealth then check out: The Ultimate Hack to Early Retirement.

Republican’s Tax Cuts and Jobs Act Spur Productivity

In our thought experiment, we’ve seen the best way to get wealth is to find some new technology or a new way of doing things that will increase productivity. So, sticking with our thought experiment, what types of things do we need to build a plow? Well, we need cash to buy wood and metal for the plow. These materials have the potential to become plows, but we also need skilled craftsmen who understand the technology needed to actualize these raw material’s potential by building them into a plow. To accomplish anything you need to recognize potential and how to actualize it. Learn about potential and how to make things happen here.

So, we need cash and know-how to get productivity gains. But US tax law prevented technology companies from using their

[Technology company’s] cash hoarding, which began in response to jurisdictional tax disparities and global economic uncertainty following the Great Recession, accelerated over the past decade as large U.S. corporations maneuvered to accumulate profits offshore in lieu of repatriating the funds and taking a tax hit.

Outdated Tax Code Prevented Investments in Productivity

In this 2014 article, Forbes goes on to explain:

We have more confirmation of what we’ve long suspected: the United States has an uncompetitive tax code … [the US] has the highest corporate income tax rate in the OECD at 39.1 percent. Second, it is one of the only countries in the OECD that does not have a territorial tax system, which would exempt foreign profits earned by domestic corporations from domestic taxation. Finally, the United States loses points for having a relatively high, progressive individual income tax rate (combined top rate of 46.3 percent) that taxes both dividends and capital gains, albeit at a reduced rate.

As a result, the United States ends up placing 32nd among the 34 industrialized nations.

Unfortunately, many politicians, instead of searching for solutions to improve the tax code, are looking for ways to make it worse. For example Senator Charles Schumer has introduced legislation that would retroactively target inverted companies with new rules.

Look, I don’t like lowering taxes on rich corporations any more than you do. But, I do want Americans to have good jobs. And that means we have to have laws that put us in the same league as other countries. The Tax Cuts and Jobs Act didn’t make us a low tax country, but it did level the playing field. The Act reduced the US Corporate tax rate to the OECD average of 21%. In our global, hyperconnected world, businesses, like Burger King, leave countries with laws that hurt them if they can find a better deal in other countries. It’s just that simple.

Paving the Way for Productivity

From the automobile to the light bulb, from the Internet to the iPhone America has long been the world’s engine for creativity and innovation. The Tax Cuts and Jobs Act just got government out of the way. It made it economically feasible for American Companies to invest in America again instead of moving their cash and factories overseas.

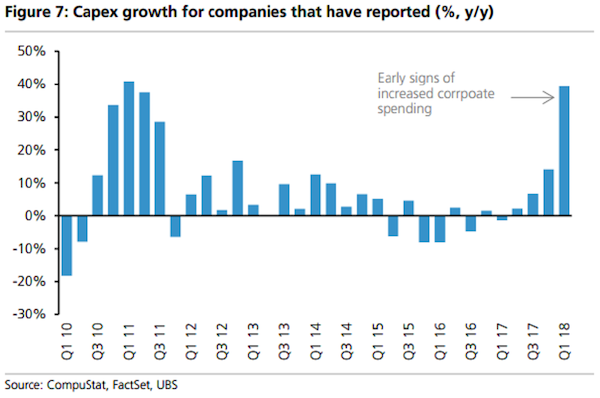

And that’s exacly what we see happening. Weeks after the Republican Congress passed the Tax Cuts and Jobs Act without a single Democrat vote Apple announced significant new investments in the US. Republican’s Economic Reforms sparked a surge in business CAPEX investments (aka plows in our thought experiment). CAPEX Investments were up 39% in the first quarter of 2018 according to Bloomberg.

Six months after these economic reforms the Bureau of Labor Statistics measured substantial increases in US productivity:

Nonfarm business sector labor productivity increased 2.9 percent during the second quarter of 2018, the U.S. Bureau of Labor Statistics reported today [versus 1.3 percent a year ago]

To be sure, the global economy is a complex beast, and it’s still too early to know precisely how productivity gains will play out. Any economic stimulus runs the risk or creating bubbles, which are still poorly understood. But, anything that moves us closer to the golden cornucopia of productivity gains is good.

More on Trump-o-nomics

Productivity growth, working smarter instead of harder, is the best way to create wealth. But, Trump and the Republican Congress have done more to drive good jobs for ordinary Americans by regulation cuts and increased spending.

Less Regulation

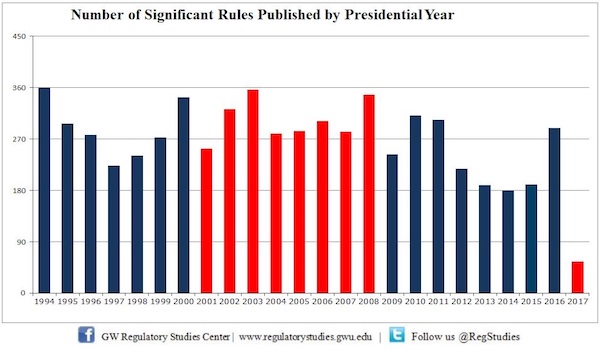

During his campaign, Trump promised to cut two regulations for every new one put in place during his term. He’s over delivered by a lot. He cut 22 regulations for every new one. CNBC summarizes Trump’s regulatory changes:

During the first year of his administration, “significant regulatory activity” had declined 74 percent from where it was in the same period of the Obama administration, according to data collected by Bridget Dooling, research professor at GW’s Regulatory Studies Center.

…

The Federal Register, where business rules are stored and thus serves as a proxy for regulatory activity, was 19.2 percent smaller from Inauguration Day until Aug. 16 under Trump than during the same period for Obama.

“You can think of that as turning off the spigot of new regulations,” Dooling said in an interview. She said more aggressive movement appears to be on the way.

Infrastructure Spending

Trump’s proposed a $1.5 trillion infrastructure spending plan to revitalize the nation’s aging infrastructure … roads, bridges, ports, etc. by partnering with State and Local Governments. But, it’s questionable how much of this will happen since it depends on action from the House of Representatives. The Democrats are predicted to win control of the House, in which case we’ll see gridlock. The Democrats will undoubtedly kill anything supported by President Trump as part of their “resist” platform. CNBC’s article summarizes this initiative.

Increased Military Spending

This year US Military spending will increase by $82 billion. In my opinion, that’s a horrible way to spend money. Spilling American Blood and Treasure overseas is abhorrent to me.

But, to be intellectually honest, more military spending does create jobs and juice the economy.

Trump-o-nomics Will Spur Growth for Years to Come

The Global Economy and America’s role in it is too complex to be boiled down into a single clickbait headline. The many moving pieces must be considered as a whole. The Establishment’s efforts to condemn Trump’s Economic Reforms as ineffective or silly by narrowly focusing their narrative on tariffs is demonstrably untrue when one considers his overall economic program.

Trump’s Tariffs are a short-term negative used to accomplish substantial long-term gains. It’s true that tariffs, when taken to extremes, are bad for the economy. But, that’s not what’s happening. Trump’s program of limited tariffs is used as a carrot and stick to correct bad trade deals negotiated by earlier administrations unwilling or unable to think outside the box. The current administration is also using the tariffs as a deterrent for predatory trade practices like Chinese Intellectual Property theft.

Other aspects of the Republican’s economic reforms more than compensate for any short-term negative from tariffs. The Tax Reform and Jobs Act removed significant barriers preventing businesses from investing in productivity gains. Cuts in regulations and spending increases act to offset any negatives from tariffs.

What do you think?

Thanks for reading to the end! This blog is my project in the pursuit of truth. I spend dozens of hours researching each blog post, so I hope you found something useful.

Our click-bait culture needs good ideas in an increasingly complex world. That depends on good men and women engaging in intellectually honest discussions, sharing ideas, and challenging each other’s thinking. Writing out my thoughts in detail, along with lots of research, helps me arrive at a more accurate view of truth based on well-documented facts.

If you’d like to support my blog please buy my book. Here’s the link!

12 Comments

Leave your reply.